Short On Time? Here’s a Quick Summary:

- Long-Term Market Resilience: While political outcomes may stir emotions, market performance historically reflects the strength of the U.S. economy over time, not the party in power. Diversified portfolios are typically more resilient to short-term political changes.

- Split Government & Market Returns: Historical data shows that markets tend to perform well under split-party government, particularly when control is divided between the White House, Senate, and House.

- Focus on Financial Goals: Election-induced volatility shouldn’t distract from long-term financial goals. Sticking to a well-planned portfolio based on individual goals, time horizon, and risk tolerance is usually the best strategy.

With Labor Day behind us, we’re in the final stretch of the 2024 presidential election race. As we follow the news and parse the most recent polls, some may ask, “How might what happens on November 5 impact my finances?”

As financial professionals, we’ve done some homework and come to the following conclusion: you may care passionately about who wins, but your investment portfolio probably doesn’t.

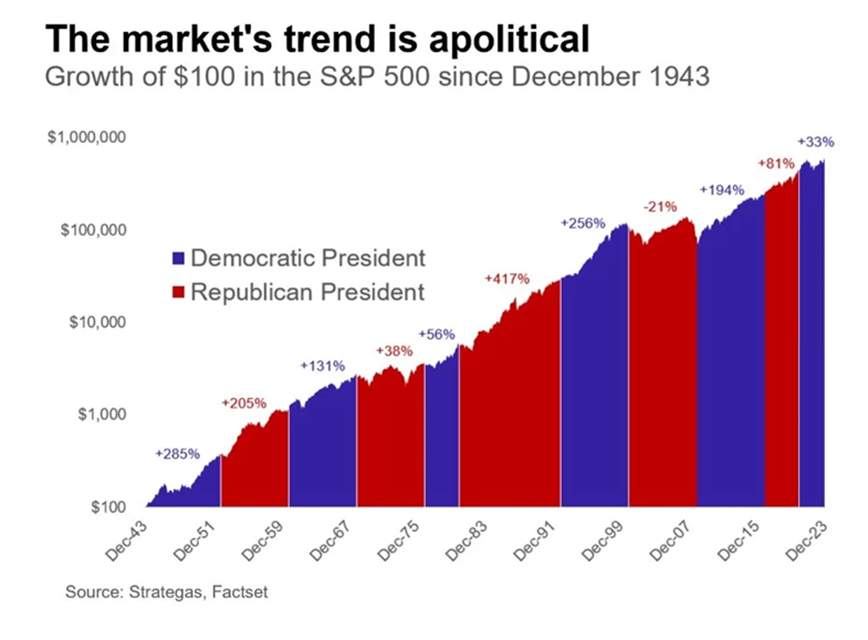

Markets Over the Long Term

Consider how the stock market has performed under Republican and Democrat presidents throughout history. As the accompanying chart shows, the stock market has fluctuated under the leadership of both parties. However, the long-term trend suggests that the stock market’s performance may have more to do with the overall strength and resiliency of the U.S. economy than the person who sits in the Oval Office.1

Stocks are measured by the Standard & Poor’s 500 Composite Index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.

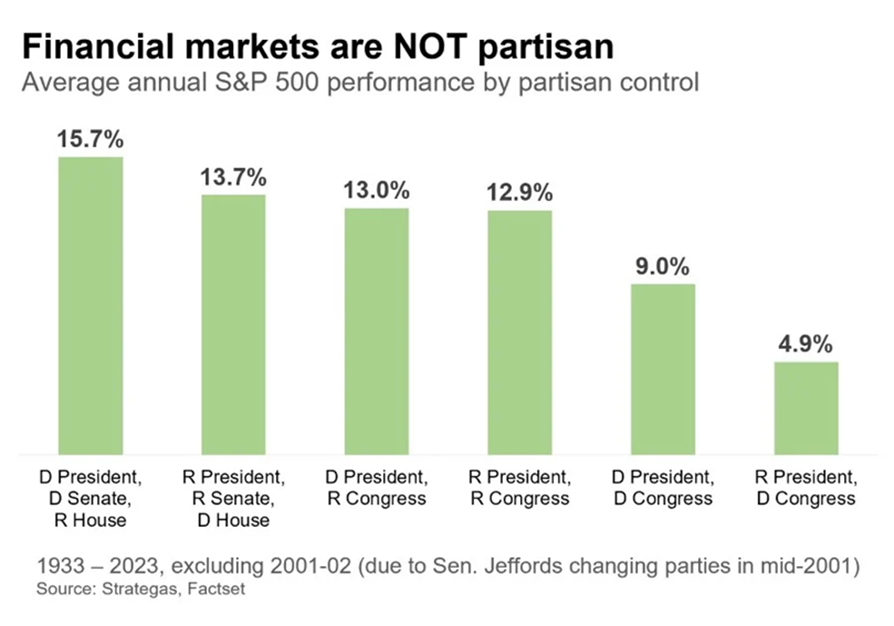

Is a Split Government Better for the Financial Markets?

While stock market performance has not historically depended on who wins the presidency, history shows that the market tends to like split control between the two major parties.

As the chart below illustrates, Democratic control of the White House and Senate, with Republican control of the House, has produced the highest average annual return.

However, the runner-up is the opposite—a Republican president and Senate and a Democratic House. While mixing and matching control of the levers of power in Washington, D.C., produced comparable results, the low results for the Republican president and Democratic Congress combo may be attributed to the 1973 oil crisis and 2008 global financial crisis bear markets.1

Stocks are measured by the S&P 500 Composite Index, an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

What Matters to the Markets

Following how election results have affected the stock market over time is fascinating. Still, data suggests economic trends tend to have a more consistent relationship with market performance than who wins in November. Improving economic conditions (which can include falling inflation) tends to create a more favorable business environment.2

The Fate of the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act of 2017 overhauled the federal tax code by adjusting individual and business taxes. Although some of the provisions were permanent, most individual tax changes are not. Unless extended, many of the changes implemented are scheduled to “sunset” on December 31, 2025. At that time, rates will revert to pre-2017 levels.3

Keep in mind this article is for informational purposes only and is not a replacement for real-life advice. Tax policy is subject to revisions during the legislative process. We encourage you to consult your tax, legal, and accounting professionals before modifying your tax strategy. Also, we always welcome collaborating with your tax professional to help align your financial and tax strategies.

Staying the Course

While elections can trigger some market volatility, it’s critical to keep short-term events in perspective and not allow them to distract you from long-term financial strategy. The best approach is often to create a portfolio that reflects your goals, time horizon, and risk tolerance.

We’re Here If You Have Questions

We’re here to help. If you are a current client and want to discuss your strategy, please contact us anytime. If you are working with another financial professional and would like us to review your overall approach, please consider reaching out.