Want to download C.H. Dean’s quick reference guide?

Click below!

2025 COLA

Each year, the Internal Revenue Service (IRS) adjusts various financial limits to account for inflation and cost-of-living changes. These adjustments impact employer-sponsored retirement plans, individual retirement accounts (IRAs), health savings accounts (HSAs), and more. Understanding these changes is crucial for effective financial planning.

Employer-Sponsored Retirement Plans

Defined Contribution Plans

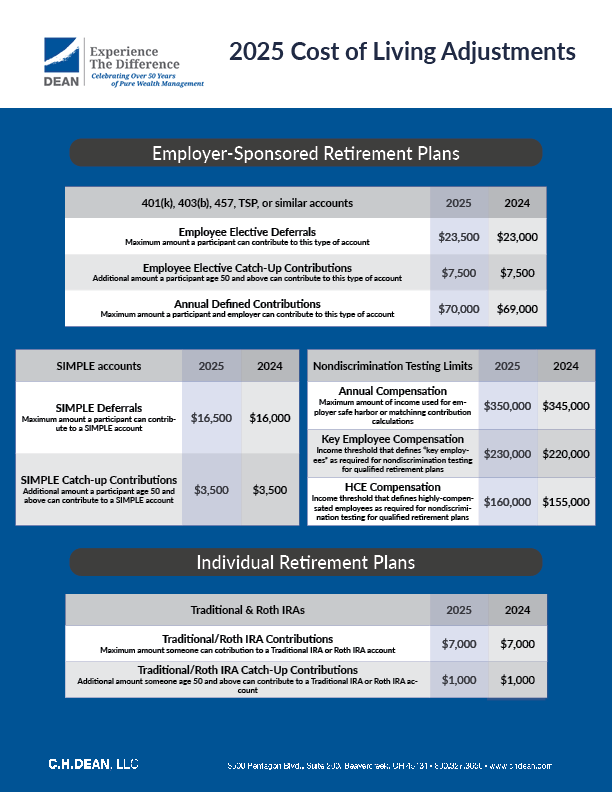

Defined contribution plans, such as 401(k), 403(b), 457, and Thrift Savings Plans (TSP), allow employees to contribute a portion of their salary toward retirement. For 2025, the IRS has set the following limits:

- Employee Contribution Limit: $23,500 (up from $23,000 in 2024).

- Catch-Up Contributions: Individuals aged 50 and over can contribute an additional $7,500, unchanged from 2024.

- Total Contribution Limit: The combined limit for employee and employer contributions is $70,000 (up from $69,000 in 2024).

Simplified Employee Pension (SEP) Plans

SEP IRAs are employer-funded retirement accounts. For 2025, contributions are limited to 25% of an employee’s compensation, up to $70,000 (up from $69,000 in 2024).

Self-employed individuals can contribute 20% of their net adjusted self-employment income, also up to $70,000.

Savings Incentive Match Plan for Employees (SIMPLE) Plans

SIMPLE IRAs and SIMPLE 401(k)s are designed for small businesses with fewer than 100 employees. For 2025, the contribution limits are:

- Employee Contribution Limit: $16,500 (up from $16,000 in 2024).

- Catch-Up Contributions: Individuals aged 50 and over can contribute an additional $3,500, unchanged from 2024.

Employers can either match employee contributions up to 3% of compensation or contribute 2% of each eligible employee’s compensation.

Individual Retirement Accounts (IRAs)

IRAs offer individuals a way to save for retirement independently of employer-sponsored plans. For 2025, the contribution limits are:

- Contribution Limit: $7,000, unchanged from 2024.

- Catch-Up Contributions: Individuals aged 50 and over can contribute an additional $1,000, unchanged from 2024.

Note that income limits may affect the deductibility of contributions to Traditional IRAs and eligibility to contribute to Roth IRAs.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged accounts for individuals enrolled in high-deductible health plans (HDHPs). For 2025, the limits are:

- Individual Contribution Limit: $4,300 (up from $4,150 in 2024).

- Family Contribution Limit: $8,550 (up from $8,300 in 2024).

- Catch-Up Contributions: Individuals aged 55 and over can contribute an additional $1,000, unchanged from 2024.

To qualify, the HDHP must have a minimum deductible of $1,650 for individuals and $3,300 for families, with out-of-pocket maximums of $8,300 and $16,600, respectively.

Flexible Spending Accounts (FSAs)

FSAs allow employees to set aside pre-tax dollars for qualified medical expenses. For 2025, the contribution limit is $3,300 per employer, up from $3,200 in 2024.

Unused funds may be forfeited at the end of the plan year, depending on the employer’s policies.

Dependent Care Accounts

These accounts enable employees to use pre-tax dollars for eligible dependent care expenses. The contribution limits for 2025 remain unchanged at $5,000 for single or married filing jointly taxpayers and $2,500 for married filing separately.

Payroll Taxes

Social Security

The Social Security wage base—the maximum income subject to Social Security tax—increases to $176,100 for 2025, up from $168,600 in 2024.

The tax rate remains at 12.4%, split equally between employers and employees.

Medicare

Medicare taxes apply to all earned income, with no wage base limit. The standard tax rate is 2.9%, also split between employers and employees. An additional 0.9% Medicare tax applies to individuals earning over $200,000 (or $250,000 for married couples filing jointly).

Federal Unemployment Tax Act (FUTA)

FUTA provides unemployment compensation to workers who have lost their jobs. The tax rate remains at 6.0% for 2025, applied to the first $7,000 of employee earnings. Employers may be eligible for a credit of up to 5.4% for state unemployment taxes paid.

Staying informed about these annual adjustments is essential for effective financial planning. Consulting with a financial advisor can help you navigate these changes and optimize your savings strategies.