When the stock market becomes volatile, it pays to have an investment plan and stick with it.

It can be tempting to try to sell investments to avoid downturns, but it is hard to time it right. Investors who sell and stay out of the market during a market rebound, can find it difficult to recover. Big stock market gains and drops are historically concentrated in just a few trading days each year.

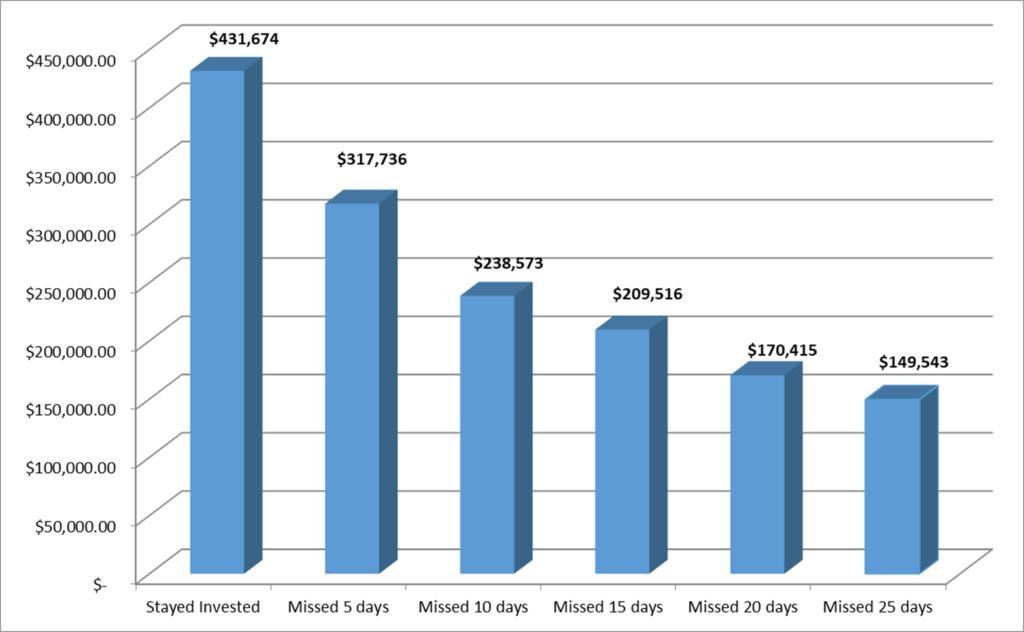

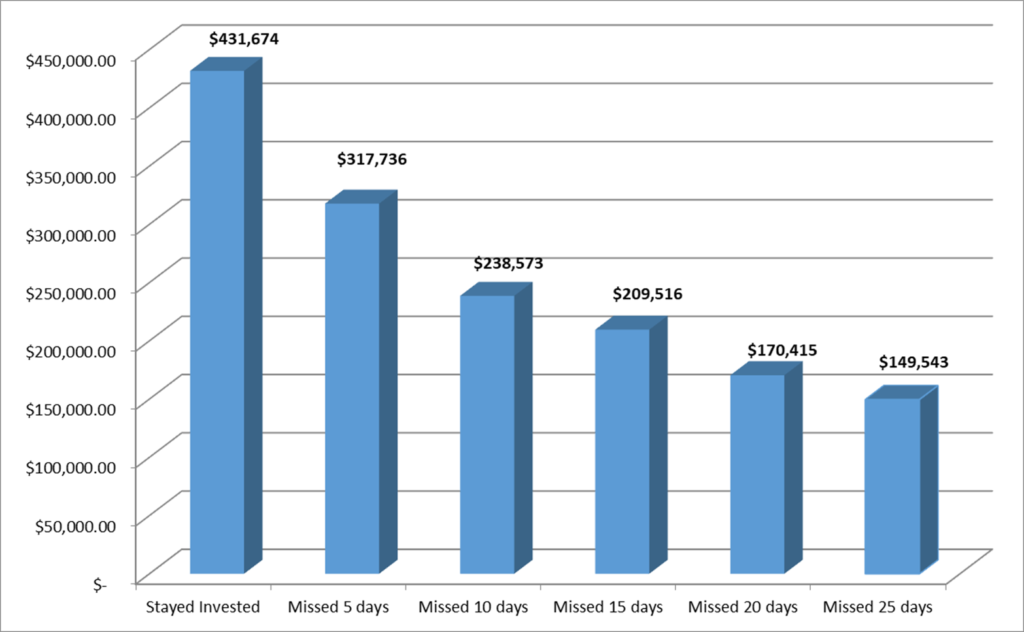

Missing only a few days can have a dramatic impact on returns.

In our opinion, history shows that timing the market is an ineffective strategy. The graph below shows the effect of a hypothetical $100,000 investment portfolio if it remained fully invested versus missing the market’s top-performing days over the 20-year period of January 1, 2001 to December 31, 2020.

Hypothetical investment of S&P 500 over a 20-year period (2001-2020)

Source: C.H. Dean. Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the US stock market. Past performance is no guarantee of future results. It is not possible to invest directly in an index. Calculation based on selling out of the market at the close price the day prior to a top-performing day and purchasing back into the market at the close price of the subsequent day.

As the above example demonstrates, a $100,000 portfolio that remained invested for the entire 20-year period in this example would have grown to $431,674. If the portfolio was not fully invested during five of the top-performing days during that same period, it would have grown to only $317,736. Missing just five top-performing trading days in this example cost $113,939. Missing 25 top-performing trading days would have cost $282,131.

This example supports our belief in staying invested at all times with an effective asset allocation in order to maximize returns and minimize risk over the long term.

Dean Investment Associates, LLC (“DIA”) and Dean Financial Services, LLC (“DFS”) are each a registered investment advisor with the SEC and wholly owned subsidiaries of C.H. Dean, LLC. Dean Capital Management, also an investment advisor registered with the SEC, serves as the sub-advisor for DIA. Dean Capital Management is an affiliate of C.H. Dean, LLC. Readers should note that staying invested or asset allocation does not guarantee a profit nor eliminate the risk of loss.