As a firm who takes pride in its disciplined approach to investing, we place a high importance on establishing an effective asset allocation that is designed to enable clients to live the life they envision.

Asset allocation means establishing an investment strategy for clients that minimizes risk and volatility in their portfolio, while maximizing returns. An effective asset allocation entails constructing an investment portfolio that divides your money among various asset classes (and sub-asset classes) that are not correlated. In essence, they don’t respond to the markets the same way at the same time. For example a portfolio could include allocations in varying amounts to these classes:

- Short-term highly liquid investments, such as short-term Treasuries

- Fixed income instruments, such as investment-grade corporate bonds and TIPS (Treasury Inflation Protected Securities)

- Equities, including small-, mid-, and large-cap that can have growth or value orientations as well as a domestic or international focus

At Dean, we believe that a diversified approach to investing makes the entire portfolio much more attractive than each of its individual parts. What’s more, the financial markets undoubtedly test every client plan on more than one occasion during its lifetime. This is why our goal as a wealth manager is to design an effective asset allocation that can withstand those ups and downs without negatively impacting our clients’ achievement of their goals.

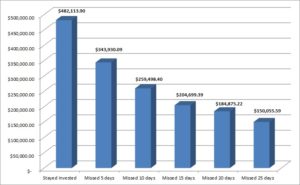

In our opinion, history shows that timing the market is an ineffective strategy. The graph below shows the effect of a hypothetical $100,000 investment portfolio if it remained fully invested versus missing the market’s top-performing days over the 20-year period of September 1, 1996, to August 31, 2016.

Missing top-performing days can hurt your portfolio

Hypothetical investment of S&P 500 over a 20-year period (1996-2016)

Source: C.H. Dean. Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the US stock market. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

As the above example demonstrates, a portfolio that remained invested for the entire time period in this example would have accumulated $482,114. If the portfolio was not fully invested during five of the top-performing days during that same period, it would have accumulated only $343,931. Missing just five top-performing trading days in this example cost $138,184, while missing 25 top-performing trading days would have cost $332,059.

This example supports our belief in staying invested at all times with an effective asset allocation in order to maximize returns and minimize risk over the long term.

Asset allocation is personal

Every client has unique goals and timelines for establishing them. Further, we’ve discovered in our years of working with clients that regardless of age, their temperament toward risk is highly personal. As a result, we customize asset allocations for each and every client based on an in-depth understanding of their goals, financial situation, and attitudes towards risk.

When a client relationship includes a spouse or partner, they often have different temperaments. To bridge the gap, we take the time to demonstrate how our recommended asset allocation can help the couple achieve their goals by minimizing risk while at the same time maximizing returns.

How our clients benefit from an effective asset allocation

Our goal is to construct portfolios that provide clients with the following important benefits:

- Peace of mind. We do not want our clients to concern themselves with the daily ups and downs of the markets. Our approach to understanding the client’s financial life, combined with their values and temperament, helps us build an effective asset allocation for them. We then build diversified portfolios that smooth the ups and downs of the client’s investment timeline.

- High probability of achieving their goals. Our intent is to help clients live the life they envision, both today and in the future. While retirement is one of the biggest goals for many, it’s not the only one for most. Education funding, providing for children or family with special needs, and charitable planning are all examples of common client goals. As such, we design an investment strategy according to when you need your money and for what purposes. We do this while also taking into account your risk tolerance.

Asset allocation is dynamic

Life is dynamic. We are all faced with positive and negative surprises throughout the course of our life. No one is immune. As clients progress closer towards achieving their goals, or are faced with those unexpected surprises, we review the asset allocation to ensure that it aligns with their life situation.

Our intent is to ensure that our clients never assume more risk than is warranted in order to live the life they envision for themselves and their families, today and in the future.

Dean Investment Associates, LLC (“DIA”) and Dean Financial Services, LLC (“DFS”) are each a registered investment advisor with the SEC and wholly owned subsidiaries of C.H. Dean, LLC. Dean Capital Management, also an investment advisor registered with the SEC, serves as the sub-advisor for DIA. Dean Capital Management is an affiliate of C.H. Dean, LLC. Readers should note that asset allocation does not guarantee a profit nor eliminate the risk of loss.